We all know our economy and stock market are not the kicking bulls they once were. I come across many soon-to-be retirees searching for a way to protect their savings, and what I have seen become more and more popular (even more so than physical metals) is precious metal IRAs.

The gold and silver IRA space is totally different than the traditional IRA/retirement account arena, so looking for information on which companies to trust (and which to not trust) is vital. Below I will mention the top companies I personally see as the most trustworthy and professional. My list is based off past customer feedback, official business ratings of the company, their business processes, and what they offer.

#1: Goldco

—> Learn More About Goldco Here <—

Goldco is the top company I am happy to recommend. Why? Well, for many reasons. First off, they are trustworthy – with years and years of experience, their precious metal agents have a ton of knowledge and education on gold and silver, allowing them to offer a customized approach for every customer, instead of a cookie cutter investment process you’ll get with many other companies.

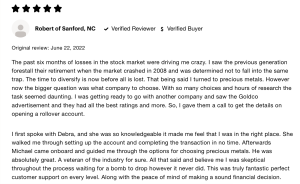

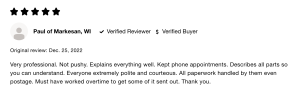

Second, their customer reviews are great. They have many return customers and thousands of 5-star reviews on Consumer affairs (screenshot below), the BBB, BCA, Google, and so on. I cannot say the same for many other companies…

In addition to their trustworthiness and positive customer reviews, they also have top-tier official business ratings on the platforms mentioned above. So basically the Better Business Bureau, Consumer Affairs, TrustLink, and TrustPilot have done their due diligence and think Goldco deserves a well-rounded A+ (or AAA) rating.

Goldco’s no pressure sales approach allows you to reach out without feeling pressured to make an investment decision you’re not quite ready for. That said, once you do decide to invest, Goldco will help you with your paperwork and the ins and outs of the investment process to make it simple and easy. They offer white glove customer service throughout the whole investment process – it’s just more enjoyable, especially when going through such a serious financial decision.

Goldco also offers a buyback program, making it easy to sell back your precious metals in case you change your mine.

All in all, Goldco is a safe company offering portfolio diversification in the form of precious metal IRAs. Even though there are many other qualified companies out there, I personally feel Goldco is the best choice for most investors. Their minimum investment is $25,000.

—> Learn More About Goldco Here <—

#2: American Hartford Gold

—> Learn More About American Hartford Gold Here <—

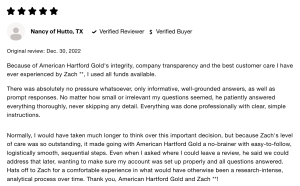

American Hartford Gold is a family-owned precious metals company with an A+ rating from the Better Business Bureau and an impressive list of accolades. It’s also one of the fastest growing private companies in the country.

American Hartford has done over $1 Billion in precious metal sales, all the while keep their business ratings and customer reviews overwhelmingly positive. They have a minimum investment of $10,000, making them a bit more inclusive than Goldco. I like American Hartford Gold because they are one of the most recognized brands in the precious metal IRA space. I see many people gravitating towards AHG for that reason; the recognizable brand gives them a level of authority many other companies don’t have.

American Hartford is also well-known for their high level of customer service. When you work with a family-owned and operated company, a certain level of comfort is met. That’s what you get with these guys.

—> Learn More About American Hartford Gold Here <—

#3: Augusta Precious Metals

—> Learn More About Augusta Precious Metals Here <—

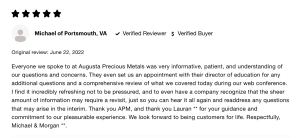

Augusta Precious Metals is an independent precious metals company that has been in business for over a decade. It provides customers with gold and silver IRAs, along with investment education and portfolio building services.

What makes Augusta different is their 1-on-1 personalized web conference with a Harvard economist. If you’re someone with over $100,000 to invest, prioritize getting a high level of education, and want to learn about the current economy, precious metals, and investing in this day and age, you have found your match. Augusta Precious Metals Minimum investment is a steep $50,000. They work with a ton of wealthy customers and are even endorsed by Joe Montana. Joe’s advisors organically found Augusta, and after being so happy with the level of service, Joe decided to become an endorser of the company.

Augusta Precious Metals has a strong reputation for integrity and transparency. It has received an A+ rating from the Better Business Bureau and was named “best of” TrustLink for six consecutive years.

Augusta Precious Metals has an experienced team of experts who are dedicated to helping people achieve their financial goals. They are also highly qualified in risk management. They are led by a Harvard-trained economist and have processed more than $2 billion in assets.

When it comes to investing in precious metals, it is important to do your research. There are a lot of scams out there. That’s why it is important to find a reputable company that can give you quality service and financial guidance.

Investing in a precious metals IRA can be a great way to hedge against inflation. However, it is important to choose a company that meets high standards and has positive customer reviews like Augusta Precious Metals.

Howard Smith is the CFO and risk management expert at Augusta Precious Metals. He has over 20 years of experience in banking and capital markets. He has worked for some of the most important banks in the world. As a certified public accountant and economics/finance graduate of the University of Toronto, he is well-positioned to help the company succeed.

—> Learn More About Augusta Precious Metals Here <—

#4: Birch Gold Group

—> Learn More About Birch Gold Group Here <—

Birch Gold Group has been in business since 2003 which makes them one of the longest-running precious metal IRA companies currently. They offer a variety of precious metals, including platinum, palladium, gold, and silver for your IRA, while many of their competitors only have gold and silver.

In addition to offering a wide variety of options for investing in a gold IRA, Birch Gold Group’s specialists can help you maximize your tax benefits by making sure you are purchasing your metals the correct way. Birch, along with the others on this list, is another company with a great pool of official business ratings and customer feedback.

The company has an excellent reputation, and has been recognized by Fox Business News, the Ben Shapiro Show, and other media outlets. It is a trusted provider for hundreds of thousands of customers, and has received 5-star ratings from several websites.

There are several different options when choosing a company to handle your IRA, and it is important to choose one that has a solid track record like Birch to ensure a positive investment decision.

—> Learn More About Birch Gold Group Here <—

#5: Noble Gold Investments

Noble Gold Investments is another top tier gold IRA company, but this one is a bit different than the rest on this list. Noble’s minimum investment is $2,000, lowering the barrier to entry even more for those with a lower amount of money to invest. They have a special tiered package program for their investors which you can find out more about here: click here.

Noble Gold Investments also offers a buyback service to its customers. Investing in gold through your IRA is a great way to diversify your investment portfolio.

—> Learn More About Noble Gold Here <—

Before selecting a gold IRA company, it is important to understand how the process works. To start, you will need to decide what kind of precious metals you would like to invest in. You can choose from silver, platinum, or gold products.

Once you have chosen the types of coins or bullion you would like to purchase, you can begin the account setup process. The best gold IRA companies make this step easy and hassle-free. They match you with an account representative to help you navigate the process.

One of the most important factors to consider when selecting a gold IRA company is integrity. You can check the Better Business Bureau (BBB) to find out if a company has received any complaints in the past. Also, read customer reviews to learn about other customers’ experiences.

You can also choose from various IRA-approved bullion products. A dedicated representative will help you decide which ones will perform best in the precious metals market.

If you have questions or concerns about your IRA, you can contact the Noble Gold team by phone or email. In addition, you can track your account status online at any time.